I didn’t have the time to do a full digest of news over the past couple weeks so I just pasted some headlines and bullet points from articles I’ve read, so you can skim them for yourselves. Overall, you’ll see a recurring theme of central bankers continuing to devalue their currencies in order to promote an expansion of debt (the life-blood of the modern-day fiat currency based fractional reserve banking system), as well as a widening gap between the east and the west. Russia continues to make strides to protect itself against economic warfare waged by the US and EU, and the EU faces new challenges from a renegade Greek prime minister who is pivoting the country towards Russia, which could send destabilizing ripples through the EU. Finally, there is continued news of the oil industry imploding under low prices, which will eventually lead to a decrease in supply, increase in prices, and continued feedback loop of demand destruction.

Central Banker Currency Devaluation Continues

“Central Banks in India and Australia Take Steps to Life Growth.” New York Times, 3 Feb 2015. [Source]

- India has decreased the amount of reserves banks are required to keep on hand, meaning they can lend more. This will likely inflate the money supply further (for more details, see my discussion on fractional reserve banking in An Economic Primer: Part 1).

- Australia lowered interest rates, a different tactic than that used by India but still aimed at inflating the money supply – good for banks and government, but bad for savers. In fact, the Aussie dollar exchange rate dropped almost instantly and now only buys 77 US cents.

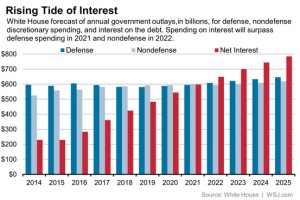

“The Legacy of Debt: Interest Costs Poised to Surpass Defense and Nondefense Discretionary Spending.” Wall Street Journal, 3 Feb 2015. [Source]

“The Legacy of Debt: Interest Costs Poised to Surpass Defense and Nondefense Discretionary Spending.” Wall Street Journal, 3 Feb 2015. [Source]

- The interest costs on the $18 trillion dollars of US debt is currently around $200 billion per year, held artificially low by near-zero percent interest rates, that could balloon to over $800 billion per year if and when the Fed starts raising interest rates.

- By 2021 spending will pass both military and non-military discretionary spending.

“Record Deflation in Eurozone.” RT, 30 Jan 2015. [Source]

- Consumer prices in Europe fell at a record pace, led mostly by energy prices.

- Europe has introduced a 1.14 trillion euro quantitative easing (money-printing) program to fight the deflation.

“The Dangerous State of Americans’ Savings.” New York Times, 30 Jan 2015. [Source]

- More than half of American families now have less than one month of income available in case of emergency.

- This access to money includes tapping into retirement accounts, which can bear expensive penalties.

- Lower income families have less than two weeks income available in savings and checking accounts.

- This report draws from several sources, including the United States Census Bureau and the University of Michigan.

“Singapore Latest to Join Currency Wars, Hits 2010 Low.” RT, 29 Jan 2015. [Source]

- Singapore unexpectedly adjusted its exchange rate to make it cheaper against the US dollar, which promotes stronger export business, monetary inflation, and a decrease in purchasing power for its citizens.

- This is a continuing global trend of nations trying to devalue their currencies more than everybody else to maintain competitive advantage in the export market.

“2015 Roadmap to Crisis.” Gordon T Long Market Research & Analytics, 17 Jan 2015. [Source]

- Gordon Long predicts we will start to see demand destruction in 2015 because of expansive credit creation in the preceding years. Creating “easy money” essentially brings demand forward, which leaves a potential demand vacuum afterwards.

- The central banks efforts to force inflation will actually lead to deflation because real income goes down, which means less spending power, which means deflation and lower prices.

Widening Gap between East and West

“Europe, not Russia Pressed Kiev over EU Association – Ex-Ukranian PM.” RT, 4 Feb 2015.” [Source]

- Former Ukranian Prime Minister Azarov has claimed EU officials, at the insistence of the US, threatened the Ukraine with a coup d’état if Kiev refused to sign an association agreement.

- According to Azarov, it was Washington that masterminded the plan to oust Yanukovich from power and replace it with a government more favorable to US interests.

“Obama Openly Admits ‘Brokering Power Transition’ in Ukraine.” Op-Ed by Bridge, Robert. 1 Feb 2015. [Source]

- In an interview with CNN, Obama admitted the US had “brokered a deal to transition power in Ukraine.”

- On 13 Dec 2014 Assistant Secretary of State Nuland stated, “Since Ukraine’s independence in 1991 the United States has…invested over $5 billion to assist Ukraine in needs and other goals,” suggesting that they were owed something by Ukraine.

- The piece referenced the infamous phone conversation recorded between Nuland and US Ambassador to Ukraine Pyatt where they openly discussed who should and shouldn’t be placed into power.

“BRICS Bank Legislation Submitted to Russian Parliament.” RT, 4 Feb 2015. [Source]

- The BRICS bank aimed at providing a rival to the International Monetary Fund (IMF) has gone to the Russian parliament.

- This will be a $100 billion bank with a $100 billion currency pool available for infrastructure and development projects within the Brazil, Russia, India, China, and South Africa.

“Domestic MasterCard: 5 Russian Banks Begin New National Payment System.” RT, 3 Feb 2015. [Source]

- Russia’s new national payment system is officially up and running, which will be an alternative to the SWIFT international payment clearing system currently used worldwide.

- Russia has created its own national payment system following fears that the US and Europe would cut Russia off from the SWIFT system, a move they did to Iran in 2012 that crippled their economy. Cutting a nation off from SWIFT practically eliminates their ability to send and receive money from other countries.

“S&P Downgrades Russia’s Credit Rating to Junk.” RT, 27 Jan 2015. [Source]

- The major credit rating agencies in the US just downgraded Russia’s sovereign credit rating to junk level, essentially the worst possible, which will cause a decrease in the flow of capital into Russia.

- Russian companies such as the gas giant Rosneft say this is meaningless in a world where they are cut off from the rest of the world due to sanctions.

- Russia and China have used this as an opportunity to promote their own credit rating agency to rival the western Big Three.

“Gazprom gets Highest Investment Grade from China’s Biggest Rating Agency.” RT, 2 Feb 2015. [Source]

- Gazprom, which was recently downgraded to near-junk investment grade by western financial institutions, was just given the highest credit rating possible by China’s own rating agency.

- “Russia and China have recently been strengthening financial and economic links in order to challenge western dominance. It includes the setting up of a join rating agency rival to the western ‘Big Three’ of Moody’s, Fitch, and S&P.”

“Russia Increases Gold Purchases by 123%.” RT, 30 Jan 2015. [Source]

- Russia purchased 6.1 billion dollars worth of gold during the first 11 months of 2014, forming a full third of the total 461 tons of gold purchased across the globe during that period.

- This is a long-term strategy to diversify the country’s reserves away from the US dollar.

Destabilization in Europe

“Greece May be ‘Weeks’ Away from Running out of Money.” Market Watch, 3 Feb 2015. [Source]

- Greece is down to about 2 billion euros as of mid-January and a series of payments on the 240 billion euro bailout are coming due, meaning there is a good chance the government will be forced to default on the debt.

“Greece Begins the Great Pivot Toward Russia.” Zero Hedge, 28 Jan 2015. [Source]

- Greece appears to be potentially pivoting quite aggressively away from Europe and towards Russia.

- Although Greece would be in for a world of hurt if they lose access to European central bank money, they could turn to the new BRICS Bank instead. This would be a strategic realignment that could hurt the EU.

“Greece-EU Clash over Anti-Russian Statement: Others May Follows Athens’ Suit.” RT, 28 Jan 2015. [Source]

- In an interview, foreign affairs analyst Trifkovic states how politically difficult it is for EU member nations to break ranks with the main ranks when it comes to sanctions on Russia. Because they require unanimity in declaring sanctions against countries, because the Greeks are signaling they may say “No” then not only could sanctions against Russia be lifted, but other countries such as Hungary may join ranks in voicing opposition to the anti-Russian sentiment.

Cycle of Oil Demand Destruction Continues

“Chevron Responds to Eight Week Drop in Rig Count by Slashing Jobs.” OilPrice.com, 30 Jan 2015. [Source]

- Chevron has decided to cut 23% of its Pennsylvania workforce following 8 straight weeks of drops in rig count – the second biggest rig drop in 22 years.

“Oil Can Recover to $200 if Supply Dries Up – OPEC Head.” RT, 26 Jan 2015. [Source]

- The head of OPEC has stated that with oil prices currently at $45-55 per barrel that if supply decreases oil could easily spike up to $200 per barrel.